Export Import procedure and documentation

In the event that you are beginning fare import business, you should be very much aware the majority of the import and fare procedure and documentation. Knowing import and fare procedure and documentation is basic on the off chance that you need all runs easily without astonishments. We will deal with fare methods.

You have to know import and fare procedure, so you can design and set up every one of the activities organized appropriately. Furthermore, you have to know documentation, supposing that you don't get ready right reports or you set up those mistakenly, at that point you may neglect to fare or import.

Fare procedure or import procedure are straightforwardly associated with documentation. Since any individual who wishes to send out necessities to give or fill the reports required for fare. Each strategy or process is identified with a few sorts of reports. Neglecting to give the records or neglecting to play out some fare strategy can prompt significant issues and expenses.

This article will clarify you the export import procedure and documentation.

To start with, let look on the import and fare procedure on the primary spot and after that, besides the documentation. SPCEFollowings are the critical import export procedure(s) what business people need to finish. Regardless of If you are sending out or bringing in, regardless of as a export/import organization or export import operator.

1. Set up organization, open business ledger and apply for import/export permit.

Followings are the critical import and export procedure what business people need to finish. Regardless of If you are sending out or bringing in, regardless of as a import and export organization or import and export operator.

With the end goal to build up an organization, you have to approach your nation fitting experts and establishments.

1st Point is, Right off the bat, you have to fill the structures, affirm your underlying capital, address points of interest, contact subtle elements, and different customs. After some time your organization will be built up. To set up an organization, you likewise need to pay some administration charges.

Note this : Previously, you choose to open an organization, we propose you thoroughly consider your fare business appropriately. It is keen to finish up fare strategy also. A fare strategy will enable you to set right exercises and set objectives and needs.

2nd Point is, you have to go to the nearby manage an account with your organization enterprise docs ( on the off chance that you have a marketable strategy, accept this too) and apply for a financial balance. You require again to fill diverse structures and answer financier inquiries regarding your future business exercises. After some time, you ought to have a current ledger opened. You require universal managing an account benefit, so you can send and get cash from abroad.

3rd Point is, after you have a current organization with the financial balance you have to apply for your import and export permit. This is likewise called as IEC number ( your import and export permit code no. Model, in India IEC, is a CODE which contains 10 digit number issued by General Director of Foreign Trade, Department of Commerce, Government of India.

In this way, all together, to apply the application, you have to way to deal with the Department of Commerce in India, in your nearby office. The following are some imperative certainties taken from the laws about acquiring the IEC in India.

Application for IEC/e-IEC

Application for getting IEC can be recorded physically and presenting the frame in the workplace of Regional Authority of DGFT.

On the other hand, an application for e-IEC might be recorded online in ANF 2A, as per Para 2.08 of Handbook of Procedure on installment of use charge of Rs. 500/ - , to be paid online through net saving money or credit/platinum card (to be operationalized in no time).

Reports/subtle elements required to be transferred/submitted alongside the application frame are recorded in the Application Form (ANF 2A).

(b) When an e-IEC is endorsed by the equipped specialist, candidate is educated through email that a PC created e-IEC is accessible on the DGFT site. By tapping on "Application Status" in the wake of having filled and presented the essential points of interest in "Online IEC Application" site page, candidate can view and print his e-IEC.

(c) Briefly, following are the essential points of interest/archives (checked duplicates) to be submitted/transferred alongside the application for IEC:

i] Details of the element looking for the IEC, according to Impex Policy 2015-20

(1) PAN of the business substance in whose name export and import would be done (Applicant individual if there should be an occurrence of Proprietorship firms).

(2) Address Proof of the candidate substance.

(3) LLPIN/CIN/Registration Certification Number (whichever is pertinent).

(4) Bank account points of interest of the element. Dropped Check bearing element's pre-printed name or Bank testament in recommended organize ANF2A.

ii] Details of the Proprietor/Partners/Directors/Secretary or Chief Executive of the Society/Managing Trustee of the substance :

1. PAN (for all classes)

2. DIN/DPIN (if there should be an occurrence of Company/LLP firm)

iii] Details of the signatory applicant as per Export Import Policy 2015-20 (FTP 2015-20) :

1. Identity evidence

2. PAN

3. Digital photo

d] In the event that the candidate has advanced mark, the application can likewise be submitted on the web and no physical application or archive is required. On the off chance that the candidate does not have computerized signature, a print out of the application recorded online appropriately marked by the candidate must be submitted to the concerned jurisdictional RA, face to face or by post.

II) No Export/Import without IEC

i) No charge or import and export will be made by any person without getting an IEC number aside from if unequivocally exempted under export and import Policy 2015-20 .

(ii) Exempt characterizations and looking at enduring IEC numbers are given in Para 2.07 of Handbook of Procedures.

iii) IEC against one Permanent Account Number.

Just a single IEC is allowed against on Permanent Account Number (PAN). On the off chance that any PAN cardholder has more than one IEC, the additional IECs will be crippled.

As should be obvious, in India without IEC number you are not permitted to import and export any products. This is comparable likewise in other creating nations like China, Vietnam, South Africa.

Just, on the off chance that you are filling in as a import and export specialist or sourcing operator, you should not have to apply for the IEC code.

Past was prework, for beginning in import and export business, now we will look genuine export and import procedure.

NB..! As a matter of fact, followings are specifically identified with exporting. On the off chance that you need to realize what are the means and strategies for bringing in, at that point read our contextual investigation about how to import from China effectively

2. Contact with purchasers and make offers.

On the off chance that your exporter organization is set up, genuine fare methodology begin. We expect, that you definitely know, what it is the thing that you will send out. If not discover best import and export openings from here.

You have to begin reaching potential purchasers from abroad. To start with, you should ensure where you can discover purchase demands. To ensure the correct promoting channels, it is vital to comprehend trade advertising. At that point you should begin straightforwardly moving toward those potential purchasers. In this fare technique, your exercise is to approve genuine purchasers. With genuine purchasers, you should begin transactions and exchanges, with ensuring purchasers correct necessities for the items.

The approval of the purchasers, this fare strategy incorporates online research and individual verification of the potential purchasers.

For approved and genuine purchasers, you should make a value offers. Value offer ought to incorporate all the significant information, for example, value, conveyance term, quality, approval period for the offer.

Purchaser can acknowledge or dismiss your offer, If dismiss, at that point you have to arrange. Whenever acknowledged, at that point let us move to the following export and import procedure.

3. Send tests to your abroad purchasers

In the event that you found a potential abroad purchaser, unquestionably, they will request that you send them an example first. You have to pack the example and ship it to your client, so they can check and test your item.

You have to utilize a plane as a vehicle. We propose utilizing DHL, TNT or some other global delivery organization. Additionally, they will assist you, with filling send out archives and will let you know, what you have to give them. Notwithstanding for test sending, you have to fill the fare assertion, where you stamp item, its HS code and, its esteem.

With test sending, you have to get ready and give following docs

*Proforma receipt ( stamp the value "0")

*Pressing rundown

*Once in a while you require give CO ( endorsement of cause)

*You require give fill the aviation route bill with the collector information, your information, goal.

More often than not, it will cost around 100 USD to dispatch little test tests however relies upon what you are sending.

NB..! In test sending import trade technique (arrange), you have to ensure every one of the confinements and obligations identified with your merchandise. Here and there a few products are confined to send out.

As a rule, there's no fare obligation, yet a few products might be confined or denied to send out in your nation. Get yourself a traditions merchant in your nation, they will enable you to make all obvious. Clarifying all obligations, directions, essential terms identified with your item is imperative import trade system, this will keep you from future astonishments.

After your purchaser, got and tried your item test, at that point in the event that he is fulfilled, they can move to the following fare system ( organize). Requesting and marking the agreements.

On the off chance that, if the purchaser wouldn't like to make a export arrange for you and it isn't connected with the item or value, at that point you should peruse why outside purchasers don't need purchase from you.

This stage has a place with the most critical import send out system.

In get, terrifically critical terms and conditions should be expressed and affirmed. At any rate following terms should be arranged and subsided into the agreement.

Cost of the products and aggregate cost

shipping date

Portrayal of the merchandise with HS code

Requested amount

Conveyance term ( EXW; FOB; CIF)

Installment terms ( TT, LC, DC)

Examination and guarantee terms

Concurred advance-installment % and balance installment %

Pressing points of interest

Required docs given by exporter

The well ordered procedure of the work

4.1. Issue proforma receipt and demand first installment

After the agreement is marked then exporter need to issue the proforma receipt to the purchaser. The purchaser needs to mastermind the development installment to affirm the request. Advance installment is normally 30% and the parity installment should be organized against the duplicate of the bill of landing.

Or on the other hand on the off chance that you are utilizing LC (Letter of credit) installment, the purchaser should open the store for you in the concurred bank. Likewise in the event that LC, all the LC conditions should be concurred, so bank knows in what conditions the LC store will be discharged to the merchant ( You).

In this stage, exporter has to know all the purchaser custom prerequisites and must make certain, that all should be possible. At that point exporter can set up all docs and declarations and send together with the products. (on the off chance that utilizing T/T installment).

In the event that LC installment, your bank will send the docs to the purchaser's bank and purchaser bank will offer over to the purchaser.

For first time exporters, it is brilliant to utilize administration of cargo forwarders and custom-specialists. They can assist you with all the import and export customs.

5. Get ready request to your client

Presently, you ought to have gotten the development installment from your client, this implies the request is affirmed.

In the event that you work 100% on LC, you ought to get a notice from the bank, that LC store is opened for you.

Nextly you have to organize the concurred request to the purchaser. You have to send the request to the transportation port. The exporter can utilize a cargo forwarder to gather, pack and send the merchandise to the transportation port.

6. Last examination by the purchaser before delivery and last installment

This is extremely basic piece of any one import and export business. Normally, the purchaser wouldn't make the last installment or tolerating the products, on the off chance that he lacks investigation and test report. Purchaser can come over and finish up the review without anyone else's input, or he can approve some outsider to do it. I si globally regular to utilize SGS for such investigations.

Last review will be done at your stockroom or on the port, before sending it to the delivery board.

This import and export technique is basic. On the off chance that examination results are not what they ought to be, you are stuck in an unfortunate situation.

7. Get balance installment against B/L and test report duplicate

Before the merchandise have been gone up against the ship board, you have to orchestrate the export custom. You have to give required subtle elements, docs to your nation custom department. It is astute to utilize the administration of a custom agent, so they will organize just for you.

Fare techniques of traditions are explicit and formal. On the off chance that you don't have past encounters, is it smart to let traditions agents and cargo forwarders organize everything for you.

In the event that you send the merchandise to the ship, you will get the Bill of filling (B/L) from a transportation organization.

Presently you are done and now you require your parity installment from your purchaser, against the duplicate of the bill of filling and different docs whenever required.

You give the duplicate of the bill of filling to the purchaser and purchaser need to organize the installment to you.

On the off chance that you utilized LC installment, you have to display every one of the docs to your bank where LC is opened for you.

After you get the parity installment or LC store, your fare hazard is finished.

This import send out technique ( arrange) is the most dangerous for the exporter, after this, all hazard will head toward the purchaser.

NB..! In import and export business, LC is regularly the best installment path for both, exporter and shipper.

8. Send all the first docs to your client and bolster him

Presently, after you have gotten the aggregate sum of your products, you have to give all the first docs to your purchaser. Purchaser needs unique docs for the import custom. Without required import and export documentations he cannot clear the bringing in traditions in his nation.

Indeed, the merchandise touch base at the purchasers port, yet the purchaser doesn't have the first docs of the products, at that point he cannot import the products into his nation.

You can send the docs with express, I more often than not utilize DHL for this.

Likewise, perhaps your client require some further assistance from you. Possibly he require some additional docs from you, so you should encourage him and give all to him. It is essential to help your purchaser since then he is frequently ready to make next request for you.

Past 6 import send out procedure(s) are generally essential. Be that as it may, we didn't deal with here, how to discover purchasers and how to choose right items or how to choose right import and export markets. You can peruse more article about those subjects underneath:

Link For More Information about How to Start export Import Business

https://www.entrepreneur.com/article/41846

https://howtoexportimport.com

http://www.eximguru.com/exim/guides/default.aspx

How to start in INDIA

https://yourstory.com/2016/07/start-your-import-export-business

In the event that you are more keen on bringing in, we are certain you cherish our very own contextual analysis about how to import from China.

Additionally, on the off chance that you are not kidding about beginning your import and export business, we have top to bottom online course: "Zero to initially bargain" you can see it in our projects.

Presently, after the import trade procedure we will demonstrate to you the most critical docs in the import and export business.

Documentation in Fare/Export Import business

Followings are the neccesary records what each exporter and shipper needs to give or get on the off chance that you are bringing in/sending out. All the accompanying docs are required for clearing export or import custom.

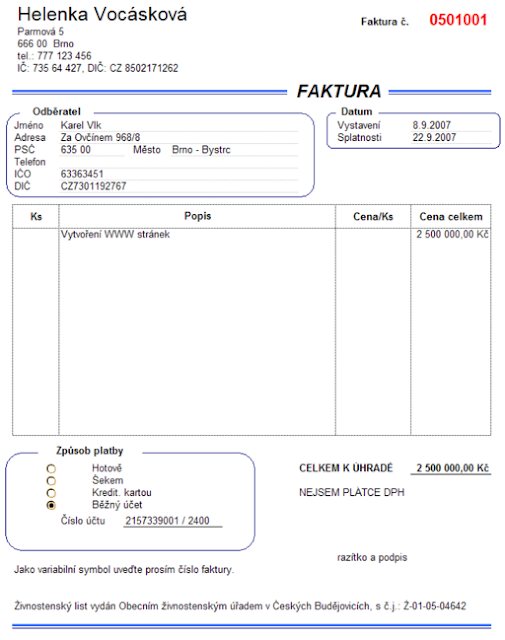

1.Proforma receipt (PI)

Required import and export report.

This is an archive, what will express the esteem per unit for the merchandise. Furthermore, will demonstrate the aggregate estimation of the products traded. Likewise, the exporter and merchant points of interest are expressed. There is no formal arrangement for the proforma receipt, simply ensure all the required information is expressed.

The following is an example proforma receipt from our very own business.

2. Deals buy contract

Has a place with required import and export documentation.

This is the evidence of procurement deal between the gatherings. You have to introduce this to your nation custom together with the proforma receipt. Deals buy contract should be all around drafted and arranged. Business visionaries should utilize the administration of expert attorneys.

It isn't shrewd to utilize the agreement shapes that are accessible on the web for nothing! We have included proficient worldwide deals buy contract frame ( prepared for utilize and alter) in our superior course.

NB..! As a matter of fact, followings are specifically identified with exporting. On the off chance that you need to realize what are the means and strategies for bringing in, at that point read our contextual investigation about how to import from China effectively

2. Contact with purchasers and make offers.

On the off chance that your exporter organization is set up, genuine fare methodology begin. We expect, that you definitely know, what it is the thing that you will send out. If not discover best import and export openings from here.

You have to begin reaching potential purchasers from abroad. To start with, you should ensure where you can discover purchase demands. To ensure the correct promoting channels, it is vital to comprehend trade advertising. At that point you should begin straightforwardly moving toward those potential purchasers. In this fare technique, your exercise is to approve genuine purchasers. With genuine purchasers, you should begin transactions and exchanges, with ensuring purchasers correct necessities for the items.

The approval of the purchasers, this fare strategy incorporates online research and individual verification of the potential purchasers.

For approved and genuine purchasers, you should make a value offers. Value offer ought to incorporate all the significant information, for example, value, conveyance term, quality, approval period for the offer.

Purchaser can acknowledge or dismiss your offer, If dismiss, at that point you have to arrange. Whenever acknowledged, at that point let us move to the following export and import procedure.

3. Send tests to your abroad purchasers

In the event that you found a potential abroad purchaser, unquestionably, they will request that you send them an example first. You have to pack the example and ship it to your client, so they can check and test your item.

You have to utilize a plane as a vehicle. We propose utilizing DHL, TNT or some other global delivery organization. Additionally, they will assist you, with filling send out archives and will let you know, what you have to give them. Notwithstanding for test sending, you have to fill the fare assertion, where you stamp item, its HS code and, its esteem.

With test sending, you have to get ready and give following docs

*Proforma receipt ( stamp the value "0")

*Pressing rundown

*Once in a while you require give CO ( endorsement of cause)

*You require give fill the aviation route bill with the collector information, your information, goal.

More often than not, it will cost around 100 USD to dispatch little test tests however relies upon what you are sending.

NB..! In test sending import trade technique (arrange), you have to ensure every one of the confinements and obligations identified with your merchandise. Here and there a few products are confined to send out.

As a rule, there's no fare obligation, yet a few products might be confined or denied to send out in your nation. Get yourself a traditions merchant in your nation, they will enable you to make all obvious. Clarifying all obligations, directions, essential terms identified with your item is imperative import trade system, this will keep you from future astonishments.

After your purchaser, got and tried your item test, at that point in the event that he is fulfilled, they can move to the following fare system ( organize). Requesting and marking the agreements.

On the off chance that, if the purchaser wouldn't like to make a export arrange for you and it isn't connected with the item or value, at that point you should peruse why outside purchasers don't need purchase from you.

4. Confirm the order from buyer and receive money

In the event that your purchaser like the example, the following import send out strategy (step) is that they will make the genuine export and import arrange for you. They will disclose to you the request amount and terms. Presently is the ideal opportunity for conclusive transaction after what you have to consent to the arrangement of offers and buy.This stage has a place with the most critical import send out system.

In get, terrifically critical terms and conditions should be expressed and affirmed. At any rate following terms should be arranged and subsided into the agreement.

Cost of the products and aggregate cost

shipping date

Portrayal of the merchandise with HS code

Requested amount

Conveyance term ( EXW; FOB; CIF)

Installment terms ( TT, LC, DC)

Examination and guarantee terms

Concurred advance-installment % and balance installment %

Pressing points of interest

Required docs given by exporter

The well ordered procedure of the work

4.1. Issue proforma receipt and demand first installment

After the agreement is marked then exporter need to issue the proforma receipt to the purchaser. The purchaser needs to mastermind the development installment to affirm the request. Advance installment is normally 30% and the parity installment should be organized against the duplicate of the bill of landing.

Or on the other hand on the off chance that you are utilizing LC (Letter of credit) installment, the purchaser should open the store for you in the concurred bank. Likewise in the event that LC, all the LC conditions should be concurred, so bank knows in what conditions the LC store will be discharged to the merchant ( You).

In this stage, exporter has to know all the purchaser custom prerequisites and must make certain, that all should be possible. At that point exporter can set up all docs and declarations and send together with the products. (on the off chance that utilizing T/T installment).

In the event that LC installment, your bank will send the docs to the purchaser's bank and purchaser bank will offer over to the purchaser.

For first time exporters, it is brilliant to utilize administration of cargo forwarders and custom-specialists. They can assist you with all the import and export customs.

5. Get ready request to your client

Presently, you ought to have gotten the development installment from your client, this implies the request is affirmed.

In the event that you work 100% on LC, you ought to get a notice from the bank, that LC store is opened for you.

Nextly you have to organize the concurred request to the purchaser. You have to send the request to the transportation port. The exporter can utilize a cargo forwarder to gather, pack and send the merchandise to the transportation port.

6. Last examination by the purchaser before delivery and last installment

This is extremely basic piece of any one import and export business. Normally, the purchaser wouldn't make the last installment or tolerating the products, on the off chance that he lacks investigation and test report. Purchaser can come over and finish up the review without anyone else's input, or he can approve some outsider to do it. I si globally regular to utilize SGS for such investigations.

Last review will be done at your stockroom or on the port, before sending it to the delivery board.

This import and export technique is basic. On the off chance that examination results are not what they ought to be, you are stuck in an unfortunate situation.

7. Get balance installment against B/L and test report duplicate

Before the merchandise have been gone up against the ship board, you have to orchestrate the export custom. You have to give required subtle elements, docs to your nation custom department. It is astute to utilize the administration of a custom agent, so they will organize just for you.

Fare techniques of traditions are explicit and formal. On the off chance that you don't have past encounters, is it smart to let traditions agents and cargo forwarders organize everything for you.

In the event that you send the merchandise to the ship, you will get the Bill of filling (B/L) from a transportation organization.

Presently you are done and now you require your parity installment from your purchaser, against the duplicate of the bill of filling and different docs whenever required.

You give the duplicate of the bill of filling to the purchaser and purchaser need to organize the installment to you.

On the off chance that you utilized LC installment, you have to display every one of the docs to your bank where LC is opened for you.

After you get the parity installment or LC store, your fare hazard is finished.

This import send out technique ( arrange) is the most dangerous for the exporter, after this, all hazard will head toward the purchaser.

NB..! In import and export business, LC is regularly the best installment path for both, exporter and shipper.

8. Send all the first docs to your client and bolster him

Presently, after you have gotten the aggregate sum of your products, you have to give all the first docs to your purchaser. Purchaser needs unique docs for the import custom. Without required import and export documentations he cannot clear the bringing in traditions in his nation.

Indeed, the merchandise touch base at the purchasers port, yet the purchaser doesn't have the first docs of the products, at that point he cannot import the products into his nation.

You can send the docs with express, I more often than not utilize DHL for this.

Likewise, perhaps your client require some further assistance from you. Possibly he require some additional docs from you, so you should encourage him and give all to him. It is essential to help your purchaser since then he is frequently ready to make next request for you.

Past 6 import send out procedure(s) are generally essential. Be that as it may, we didn't deal with here, how to discover purchasers and how to choose right items or how to choose right import and export markets. You can peruse more article about those subjects underneath:

Link For More Information about How to Start export Import Business

https://www.entrepreneur.com/article/41846

https://howtoexportimport.com

http://www.eximguru.com/exim/guides/default.aspx

How to start in INDIA

https://yourstory.com/2016/07/start-your-import-export-business

In the event that you are more keen on bringing in, we are certain you cherish our very own contextual analysis about how to import from China.

Additionally, on the off chance that you are not kidding about beginning your import and export business, we have top to bottom online course: "Zero to initially bargain" you can see it in our projects.

Presently, after the import trade procedure we will demonstrate to you the most critical docs in the import and export business.

Documentation in Fare/Export Import business

Followings are the neccesary records what each exporter and shipper needs to give or get on the off chance that you are bringing in/sending out. All the accompanying docs are required for clearing export or import custom.

1.Proforma receipt (PI)

Required import and export report.

This is an archive, what will express the esteem per unit for the merchandise. Furthermore, will demonstrate the aggregate estimation of the products traded. Likewise, the exporter and merchant points of interest are expressed. There is no formal arrangement for the proforma receipt, simply ensure all the required information is expressed.

The following is an example proforma receipt from our very own business.

2. Deals buy contract

Has a place with required import and export documentation.

This is the evidence of procurement deal between the gatherings. You have to introduce this to your nation custom together with the proforma receipt. Deals buy contract should be all around drafted and arranged. Business visionaries should utilize the administration of expert attorneys.

It isn't shrewd to utilize the agreement shapes that are accessible on the web for nothing! We have included proficient worldwide deals buy contract frame ( prepared for utilize and alter) in our superior course.

3. Packing list (PL)

Mandatory import and export procedures and documentation

Packing list states the quantity of the goods exported. Also those packing and weights and CBM,s. also, the amount of the packages are stated on the packing list.

On the packing list, also the product HS code is marked.

HS code is a code, that all the nations understand same way. This code will determine the import duties and other formalities.

HS code is a code, that all the nations understand same way. This code will determine the import duties and other formalities.

Below is again one example of our Chinese partner

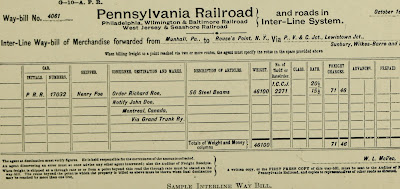

4. Bill of landing/Aviation route charge/Railroad bill

Pivotal import and export record for merchants custom.

Afer, the products had been gone up against the shipboard, at that point shipper will issue the Bill of landing ( B/L). This archive affirms, that merchandise had been gone up against the ship and are prepared for transportation.

This is the evidence for beneficiaries and banks that the merchandise are prepared for shipment.

Essentially, on the off chance that the merchandise are transported by the plane, there is aviation route bill. On the off chance that merchandise are transported via Train, there is railroad bill.

5.Certificate of Cause (C/O)

This is critical doc what is required by nations traditions. This doc can bring down the import obligations now and again and without this occasionally sending out is outlandish. This doc will demonstrate, that the merchandise are from the nation by which the C/O is issued.

Additionally, the C/O contains the maker information. This is an official doc what can be issued just by nation export import and exchanging specialists. Typically, to issue the endorsement of starting point, this will cost some cash.

6. CE authentication

CE has a place with the import and export methodology and documentation on the off chance that you are sending out to Europe.

With every one of the items, the CE authentication is required, in exchanging with Europe.

The maker more likely than not been affirmed by third nation to have CE endorsement. CE affirms, that the item meets the European Association security benchmarks.

7. Material wellbeing sheet (MSD)

In some cases this report is required by bringing in nation custom. This doc can be issued by the exporter and must affirm that item isn't hurtful to the people and nature. This doc is typically required for fluids.

8. Cargo protection authentication

This doc isn't compulsory in import and export documentation.

In the event that the merchandise are valuable, ordinarily the purchaser necessitates that exporter signs protection approach for the products. The protection authentication is issued by organizations who give protections. Likewise the universal transportation organizations like DHL, DSV give the protections.

The following is one case of our own import and export business:

The past archives and the import send out methods are the most widely recognized ones in the import and export business.

Decision about export and import procedure and documentation

There are part more archives and techniques that are required if sending out some explicit item. For sustenance item model, exporter needs to give wellbeing review authentications and clean testament.

Some import and export procedure and documentation can end up being expensive too. All costs should be considered for your import and export business

With the end goal to apply those authentications, exceptional export and import procedure(s) should be closed.

In the event that to send out therapeutic items, the standards are significantly more strict and extraordinary licenses may need to apply. At that point import trade procedure(s) and documentation could be considerably more intricate and include exceptional establishments and associations.

NB..! That is the reason, at the phase of sending the examples to the purchasers, you have to ensure what docs and licenses are required by bringing in gathering custom for an explicit item.

Some of the time it might come clear, that a few docs cannot be issued. At that point likewise the item cannot be an exporter. It is critical to ensure at the simple start.

Past were essential import send out procedure and documentation, we trust it was valuable.

In the event that you might want to take in more and get individual help with export and import procedure, at that point we have send out import business tutoring administration

FOR MORE INFORMATION

FOR MORE INFORMATION ABOUT IMPORT AND EXPORT BANK OF INDIA

FOR MORE INFORMATION

FOR MORE INFORMATION ABOUT IMPORT AND EXPORT BANK OF INDIA

.jpg)

0 Comments